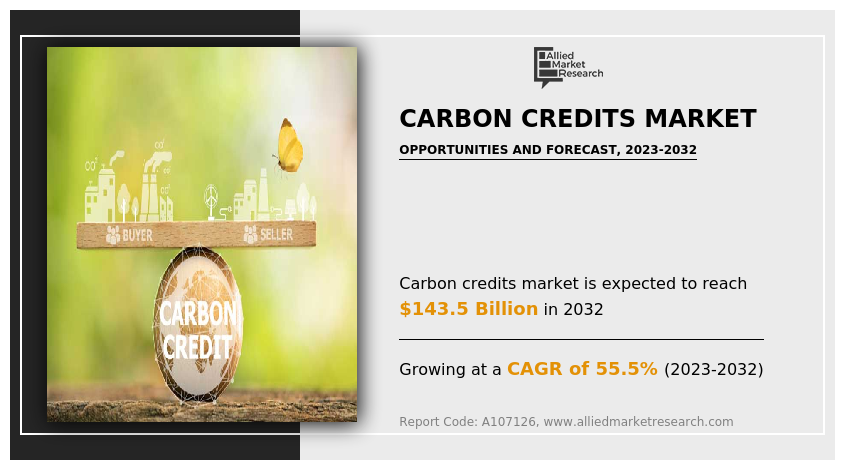

Carbon Credits Market to Reach $143.5 Billion by 2032: Driving Climate Action Through Global Emission Offsetting

The carbon credits market is projected to skyrocket from $2B in 2022 to $143.5B by 2032, driven by climate goals, policy support, and innovation.

WILMINGTON, DE, UNITED STATES, June 23, 2025 /EINPresswire.com/ --

The global carbon credits market is experiencing an unprecedented growth trajectory, fueled by global climate change awareness, net-zero commitments, and the need for sustainable business practices. According to a new report by Allied Market Research, the carbon credits market size was valued at $2 billion in 2022 and is projected to reach $143.5 billion by 2032, expanding at a remarkable CAGR of 55.5% from 2023 to 2032.

Download PDF Brochure: https://www.alliedmarketresearch.com/request-sample/107610

What Are Carbon Credits?

Carbon credits, also referred to as carbon offsets, are tradable permits that allow organizations and individuals to compensate for their greenhouse gas (GHG) emissions. One carbon credit typically equals one metric ton of carbon dioxide (CO₂) either removed from the atmosphere or prevented from being emitted.

These credits are created through a variety of emission reduction or removal projects, including:

Renewable energy installations (e.g., wind or solar)

Reforestation and afforestation projects

Methane capture from landfills or agriculture

Energy efficiency improvements

How Carbon Credits Work

The carbon credits system operates on an offsetting principle. Companies, individuals, or governments that emit GHGs can purchase carbon credits to balance their carbon footprint. Funds from these purchases are invested in sustainable projects that remove or avoid GHG emissions, allowing buyers to offset their environmental impact.

The credits are bought and sold via carbon exchanges or through verified third-party platforms, with the credits being “retired” after use to prevent double-counting.

Regional Insights: Asia-Pacific Leads the Market

In 2022, the Asia-Pacific region emerged as the dominant player in the global carbon credits market, and it is projected to maintain this lead throughout the forecast period. Factors such as increasing industrial activity, stronger government regulations, and regional sustainability initiatives contribute to this leadership.

Key Players in the Carbon Credits Market

Several companies are at the forefront of the carbon credits market growth, including:

South Pole

3Degrees

EKI Energy Services Ltd

TerraPass

Moss.Earth

Climate Impact Partners

CarbonBetter

NativeEnergy

These organizations help facilitate the development, verification, and trading of carbon credits on voluntary and regulated markets.

Buy This Report (280 Pages PDF with Insights, Charts, Tables, and Figures): https://bit.ly/44HOP3I

Types and Systems of Carbon Credits

The carbon credits market is segmented by:

Type:

Regulatory: Mandated by government policies (e.g., cap-and-trade systems)

Voluntary: Driven by organizations looking to go beyond compliance

System:

Cap-and-Trade: Emissions cap set by authorities, with tradable credits among emitters

Baseline-and-Credit: Credits generated by entities performing better than set baselines

End-Use Industry:

Aviation

Energy

Industrial

Petrochemical

Others

Carbon Credits: A Gateway to Net-Zero

In order to meet the global net-zero emissions target, GHG emissions must be halved by 2030 and reduced to near-zero by 2050. Carbon credits play a vital role in achieving these targets by:

Supporting climate-positive projects

Enabling businesses to compensate for unavoidable emissions

Fostering innovation in low-carbon technologies

For companies, participating in voluntary carbon markets enhances brand reputation, encourages operational efficiency, and demonstrates environmental leadership.

Added Benefits of Carbon Credit Projects

Beyond emission reduction, carbon credit projects often bring co-benefits, such as:

Improved air and water quality

Job creation in renewable energy sectors

Biodiversity restoration through reforestation

Sustainable community development

Many carbon offset projects integrate United Nations Sustainable Development Goals (SDGs) into their frameworks, ensuring they deliver social, economic, and environmental value.

Market Trends & Future Outlook

The carbon credits market forecast suggests explosive growth over the next decade, driven by:

Corporate sustainability pledges

Government mandates for carbon pricing

Investor focus on ESG (Environmental, Social, Governance) factors

Expansion of digital carbon marketplaces

As awareness grows, more private and public entities are entering carbon markets to trade offsets and drive emission-neutral practices.

Enquiry Before Buying: https://www.alliedmarketresearch.com/purchase-enquiry/107610

COVID-19 Impact on the Carbon Credits Market

The COVID-19 pandemic temporarily hampered the carbon credits market due to:

Reduced industrial and aviation activity

Project delays

Supply chain disruptions

Decreased funding for sustainability programs

However, post-pandemic recovery has reignited global climate action, with many countries integrating green recovery plans into their economic stimulus packages, providing renewed momentum for carbon credit investments.

Final Thoughts

The carbon credits market is poised to play a central role in the global transition to a low-carbon economy. As more organizations aim for net-zero emissions, the demand for high-quality carbon credits is expected to surge. Regulatory frameworks, technological innovation, and voluntary climate action will collectively shape the market's future.

For businesses and nations alike, carbon credits represent not just a compliance tool, but a powerful strategy for climate responsibility and global impact.

Trending Reports in Energy and Power Industry:

Carbon Credits Market

https://www.alliedmarketresearch.com/carbon-credits-market-A107126

Carbon Credit Trading Platform Market

https://www.alliedmarketresearch.com/carbon-credit-trading-platform-market-A145082

Carbon Capture and Sequestration Market

https://www.alliedmarketresearch.com/carbon-capture-and-sequestration-market-A129862

Decarbonization Market

https://www.alliedmarketresearch.com/decarbonization-market-A325581

Bioenergy With CCS Market

https://www.alliedmarketresearch.com/bioenergy-with-ccs-market-A325513

Carbon Capture and Storage (CCS) in Power Generation Market

https://www.alliedmarketresearch.com/carbon-capture-and-storage-in-power-generation-market-A212152

Carbon Capture, Utilization, and Storage (CCUS) Market

https://www.alliedmarketresearch.com/carbon-capture-and-utilization-market-A12116

Carbon Capture Technology Market

https://www.alliedmarketresearch.com/carbon-capture-technology-market-A191506

Carbon Capture Market

https://www.alliedmarketresearch.com/carbon-capture-market-A175658

AI in Energy Market

https://www.alliedmarketresearch.com/ai-in-energy-market-A12587

Artificial Intelligence in Renewable Energy Market

https://www.alliedmarketresearch.com/artificial-intelligence-in-renewable-energy-market-A224072

Solar Energy Market

https://www.alliedmarketresearch.com/solar-energy-market

Renewable Energy Market

https://www.alliedmarketresearch.com/renewable-energy-market

U.S. Clean Energy Market

https://www.alliedmarketresearch.com/us-clean-energy-market-A325461

Clean Energy Infrastructure Market

https://www.alliedmarketresearch.com/clean-energy-infrastructure-market-A323711

Clean Energy Market

https://www.alliedmarketresearch.com/clean-energy-market-A43785

Green Energy Market

https://www.alliedmarketresearch.com/green-energy-market

About Us

Allied Market Research (AMR) is a full-service market research and business-consulting wing of Allied Analytics LLP based in Portland, Oregon. Allied Market Research provides global enterprises as well as medium and small businesses with unmatched quality of "Market Research Reports" and "Business Intelligence Solutions." AMR has a targeted view to provide business insights and consulting to assist its clients to make strategic business decisions and achieve sustainable growth in their respective market domain.

Pawan Kumar, the CEO of Allied Market Research, is leading the organization toward providing high-quality data and insights. We are in professional corporate relations with various companies and this helps us in digging out market data that helps us generate accurate research data tables and confirms utmost accuracy in our market forecasting. Each and every data presented in the reports published by us is extracted through primary interviews with top officials from leading companies of domain concerned. Our secondary data procurement methodology includes deep online and offline research and discussion with knowledgeable professionals and analysts in the industry.

David Correa

Allied Market Research

+ 1800-792-5285

email us here

Visit us on social media:

LinkedIn

Facebook

YouTube

X

Distribution channels: Energy Industry, Environment

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.

Submit your press release